XRP (XRP) price dropped below $1.50 over the weekend, its lowest level in over 14 months. Now, a bearish technical setup on the charts suggests that the downtrend may extend throughout February.

Key takeaways:

-

XRP’s bear pennant on the four-hour chart targets $1.22.

-

XRP futures open interest dropped to $2.61 billion, which gives some hope for the bulls.

XRP price chart shows a textbook bear pennant

On Saturday, XRP price fell about 14% from a high of $1.75 to a low of $1.50, losing the $1.60 support level for the first time since November 2024.

The latest drop has put it into the breakdown phase of its bear pennant setup, as shown on the four-hour chart below.

Related: Price predictions 1/30: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, XMR

XRP dropped below the pennant’s lower trendline on Tuesday, then rebounded to retest it as support. The price is likely to drop lower if the retest fails and a four-hour candlestick closes below this level at $1.58.

The measured target of the bear pennant, calculated by adding the height of the initial drop to the breakout point, is $1.22, representing a 23% drop from the current price.

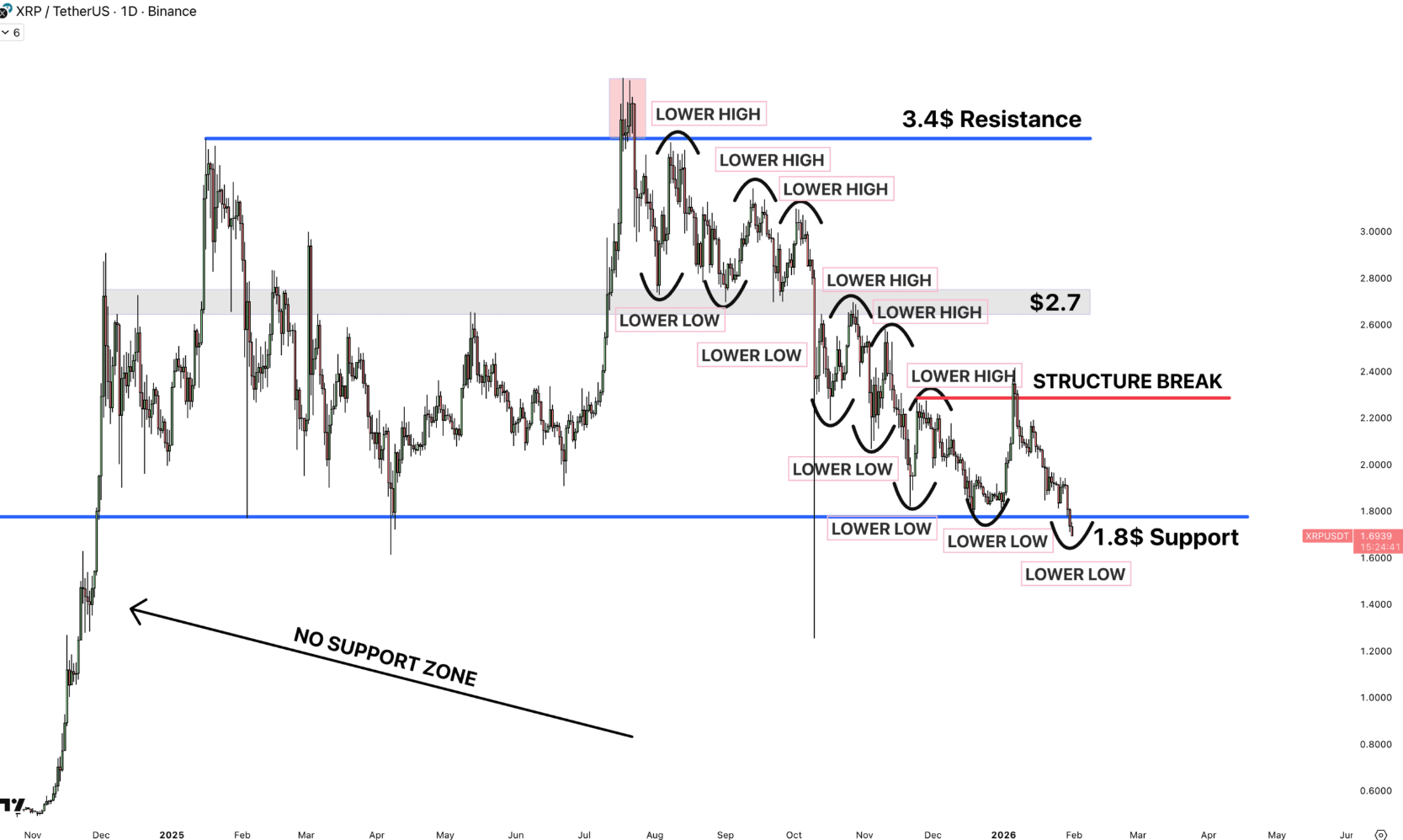

XRP’s recovery to $2.40 in January turned out to be a “fakeout” as the price continued to form “price formed a fresh lower lows,” pseudonymous analyst AltCryptoGems said in a recent post on X, adding:

“The downtrend remains intact and we are on the verge of a disastrous collapse in a huge no-support zone.”

Trader and investor Alex Clay said that after breaching the support line of a double bottom pattern at $1.60, the path is now cleared for a drop toward $1 or lower.

As Cointelegraph reported, XRP’s next major support level is near its aggregated realized price at $1.48. If this level is lost, it would put the average holder underwater, a setup that closely matches the 2022 bear phase that ultimately ended in a 50% drawdown toward $0.30.

XRP buyers step back

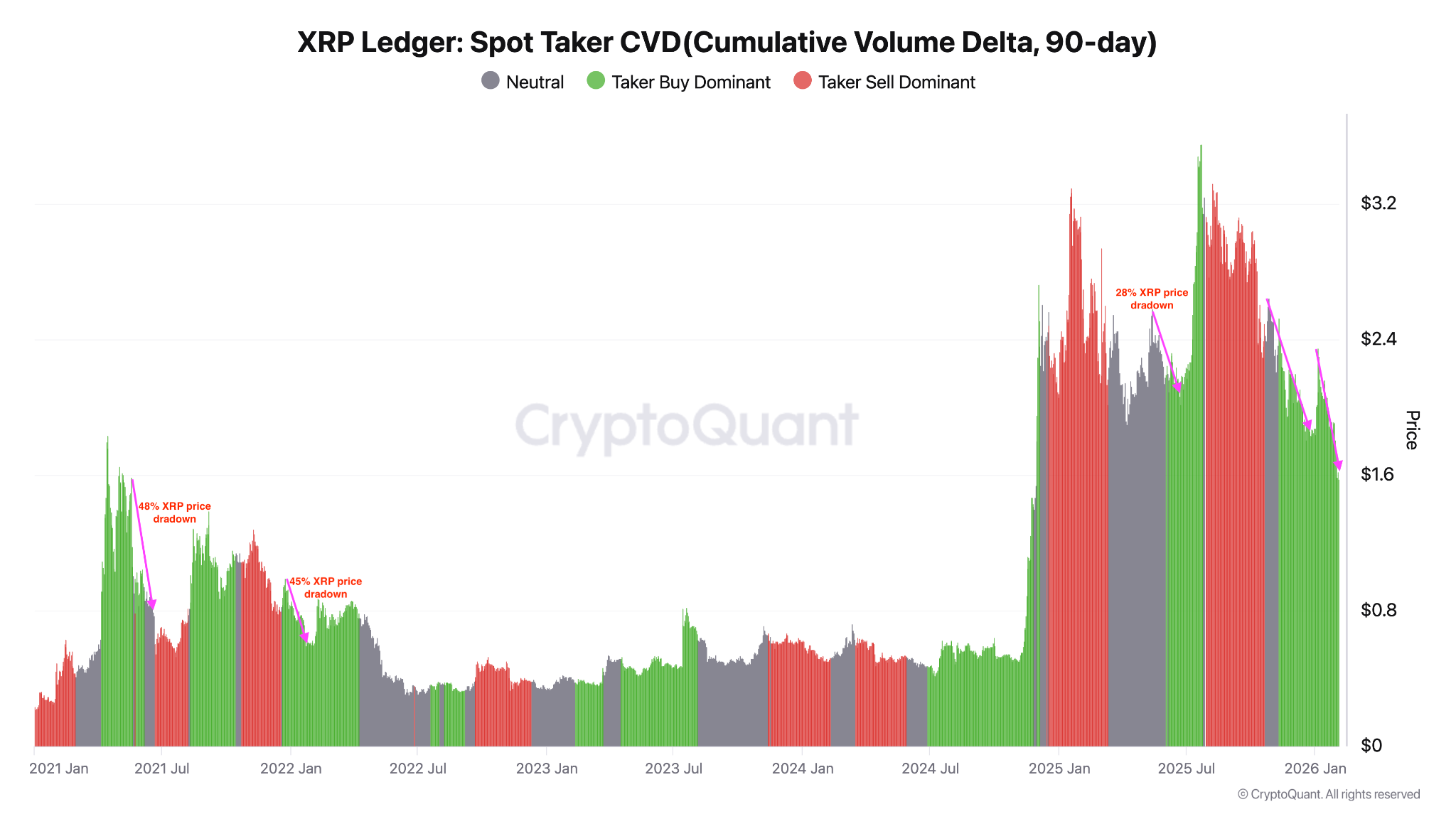

The 90-day Spot Taker Cumulative Volume Delta (CVD), a metric that tracks whether market orders are driven by buyers or sellers, reveals that buy-orders (taker buy) have been declining sharply since early January.

While demand-side pressure has dominated the order book since November 2025, buy orders have dropped sharply over the last 30 days, according to CryptoQuant.

This indicates waning enthusiasm or exhaustion among XRP investors, signaling reduced bullish momentum and increasing downside risk for the price.

Previous sharp drops in spot CVD have been accompanied by 28%-50% price drawdowns within weeks.

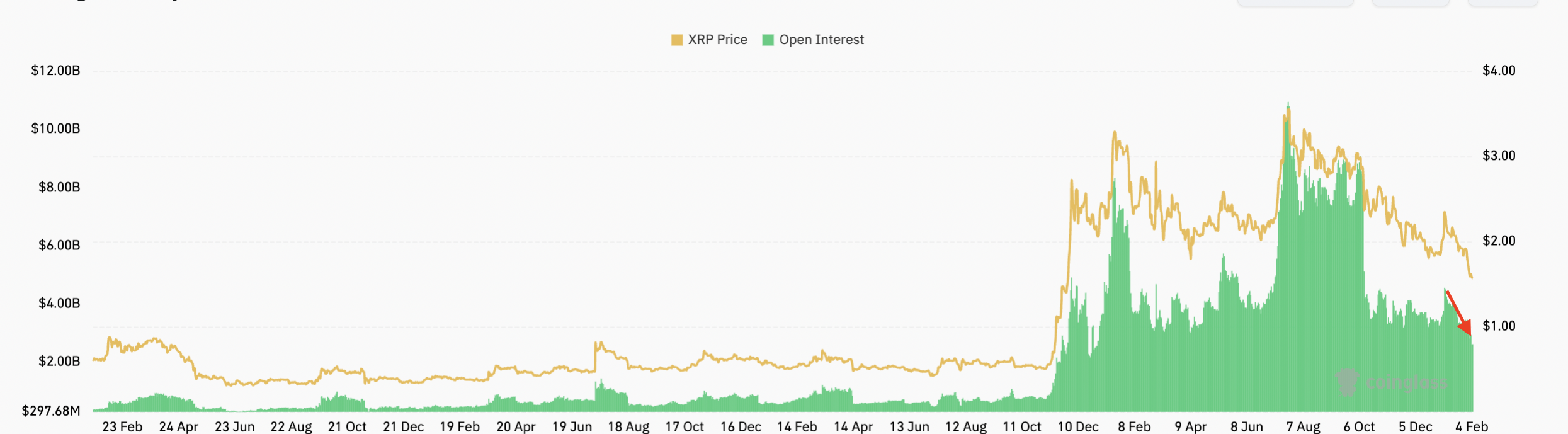

However, in the current downtrend, one hope for the bulls is the declining XRP futures open interest (OI). It has dropped sharply to $2.61 billion on Wednesday, from $4.55 billion on Jan. 6.

When OI declines in combination with falling prices, it indicates a weakening bearish trend or a potential trend reversal.

This could provide some fuel for the bulls to test the important overhead resistance at around $1.85, a level that served as support throughout most of 2025.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.