Crypto markets stalled as investors locked in losses; bitcoin mining difficulty jumped 14%; the Ethereum Foundation unveiled an updated roadmap—and other highlights of the week.

Markets in the red

Digital assets remain range-bound, with momentum tilted negative. Over the past week bitcoin lost about 4%, and 25% over the past 30 days.

On Monday the bellwether traded around $70,000, slid to a local low near $65,000 by Thursday, and recovered to $67,000 by Sunday.

Hourly chart of BTC ($67,592.00 · Live)/USDT ($1.00 · Live) on Binance. Source: TradingView.

Hourly chart of BTC ($67,592.00 · Live)/USDT ($1.00 · Live) on Binance. Source: TradingView.Ethereum followed bitcoin, failing to hold the psychological $2,000 level. The coin fell 5.5% over seven days.

Hourly chart of BTC/USDT on Binance. Source: TradingView.

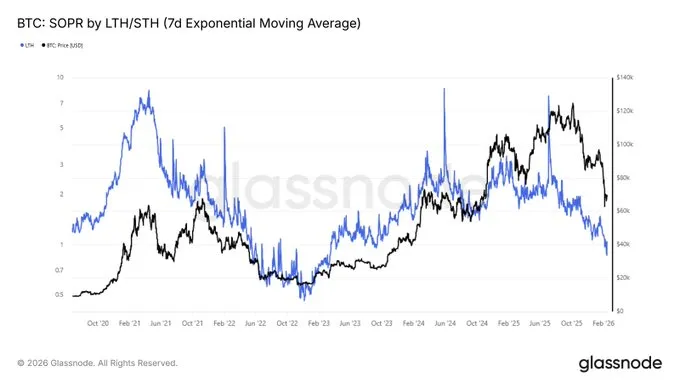

Hourly chart of BTC/USDT on Binance. Source: TradingView.Analysts at Glassnode noted that a drop in the price of the bellwether to $60,000 put psychological pressure on long-term holders comparable to the collapse of the Terra ecosystem in May 2022.

According to their data, the seven-day exponential moving average of SOPR for this cohort fell below 1. That implies they began selling at sizeable losses—a rare shift in behaviour typically seen in deeper bear-market phases.

Source: Glassnode/X.

Source: Glassnode/X.Inflows to trading platforms have also weakened.

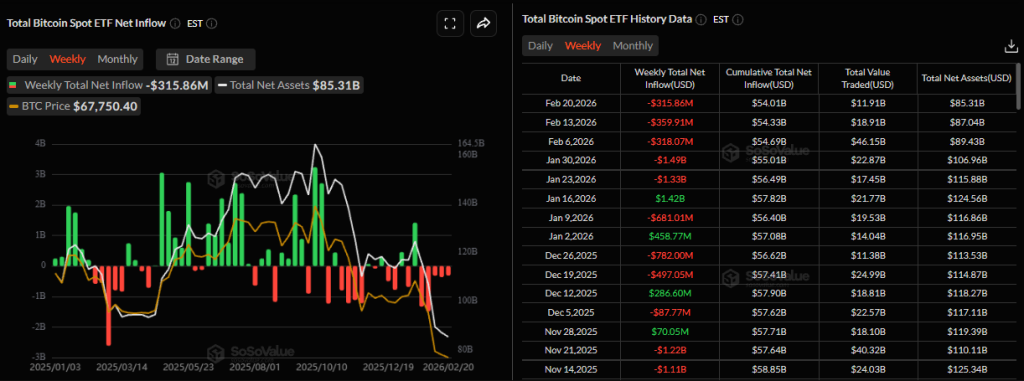

The crypto correction has pushed many professional investors into more liquid assets or higher cash balances, Bloomberg said. This is echoed by outflows from US spot bitcoin ETFs, now in their fifth consecutive week.

Source: SoSoValue.

Source: SoSoValue.Technical analysts spotted a “bear pennant” shaping up on bitcoin and Ethereum, pointing to targets of $55,000 and $1,100, respectively.

Daily chart of BTC/USDT on Binance. Source: TradingView.

Daily chart of BTC/USDT on Binance. Source: TradingView.The “pennant” forms when, after a sharp drop (the “flagpole”), prices compress into a narrowing range. A break below typically triggers another leg lower on a scale comparable to the initial move.

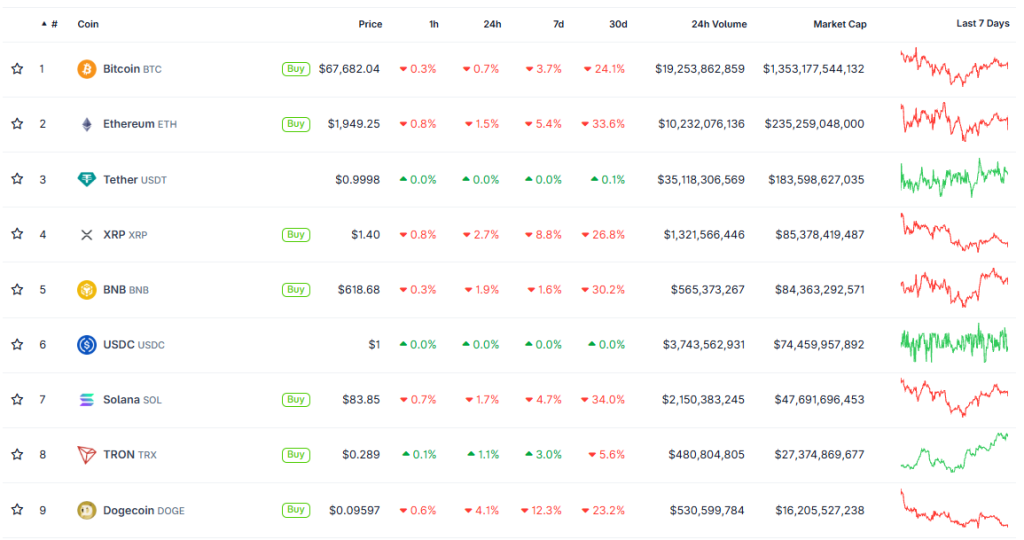

Other top‑10 cryptoassets were also in the red. TRX ($0.29 · Live) was the exception, up 3%.

Source: CoinGecko.

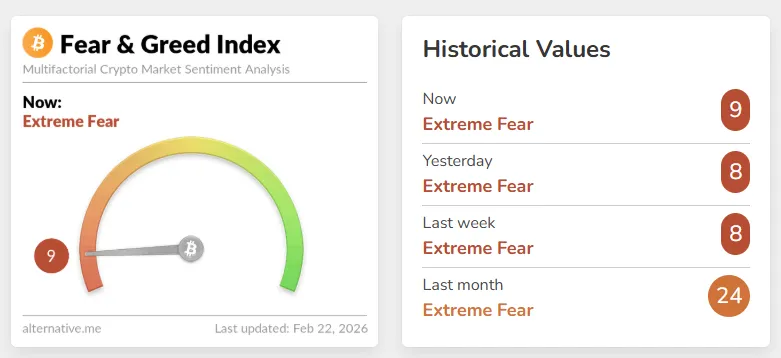

Source: CoinGecko.The Crypto Fear and Greed Index remains near lows at 9.

Crypto Fear and Greed Index. Source: Alternative.

Crypto Fear and Greed Index. Source: Alternative.Total crypto market capitalisation fell from $2.45trn to $2.45trn.

Bitcoin dominance stands at 56.6%, Ethereum at 9.8%.

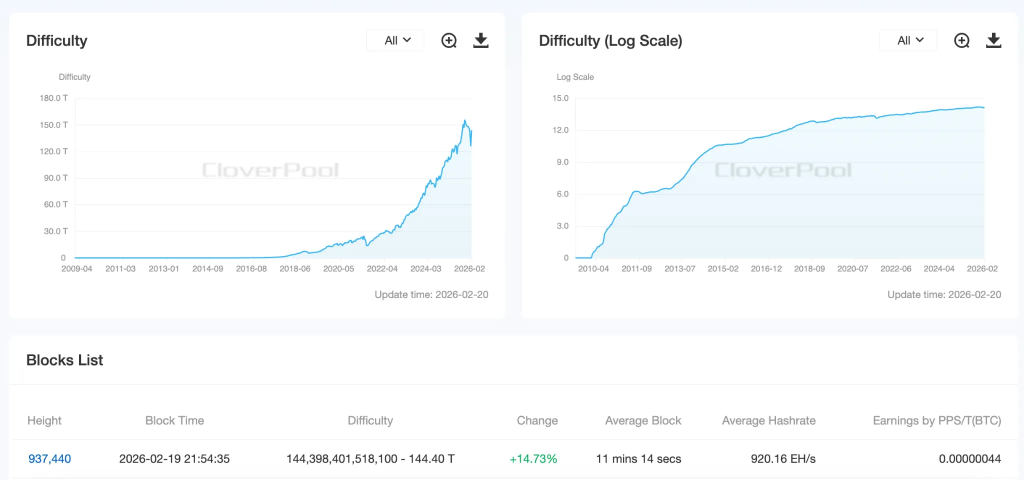

Mining difficulty

On 19 February, bitcoin mining difficulty rose by 14.73% to 144.4 T—among the biggest changes since 2021.

Source: CloverPool.

Source: CloverPool.In the previous adjustment the metric adjusted by 11%. Severe weather had prompted many large miners to pause operations, distorting the network hashrate.

The metric now holds above 1 ZH/s.

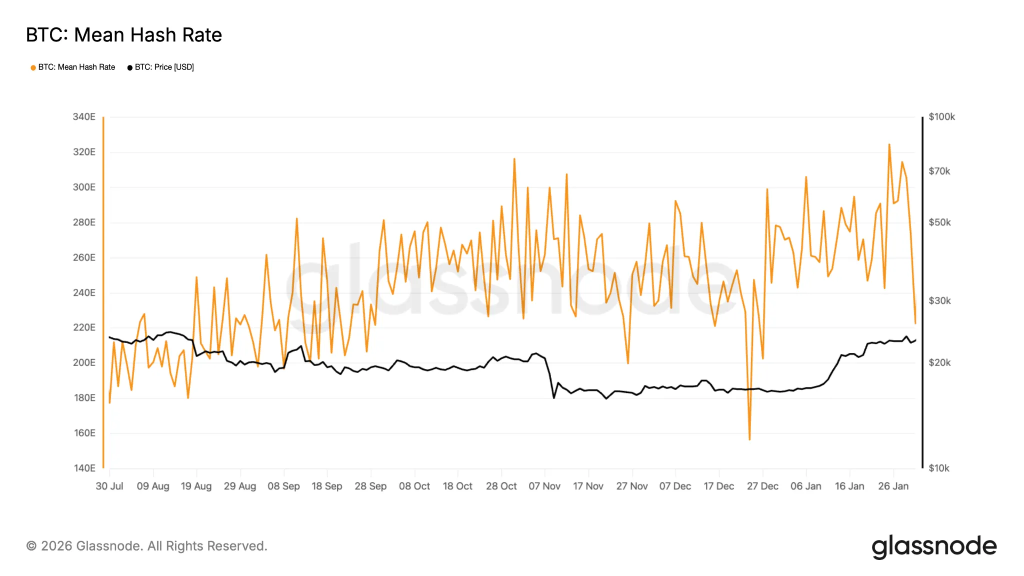

Source: Glassnode.

Source: Glassnode. But while hashrate rebounded after a brief dip, hashprice keeps falling. Over the week it declined from $34 to $28 per PH/s per day.

Source: Hashrate Index.

Source: Hashrate Index. Despite falling profitability, operators with access to cheap power keep scaling up. The UAE’s unrealised profit from bitcoin mining reached $350m.

Some companies are taking the opposite approach. Miner Bitdeer reported selling all the bitcoin on its balance sheet. It had been selling slowly; last week it put 943.1 BTC on the market.

Even so, Bitdeer overtook MARA Holdings by its own hashrate, becoming the leader among public miners.

The company now ranked second by capacity this week closed a deal to buy a 64% stake in AI‑infrastructure provider Exaion—evidence of big miners’ push to diversify.

What to discuss with friends?

- OpenAI released a benchmark to assess AI agents’ ability to hack smart contracts.

- Keyrock: Treasuries affect bitcoin’s price more than the Fed.

- The Sharpe ratio hinted at a near‑term bitcoin recovery.

- 85% of tokens launched in 2025 fell below their initial price.

Plans to safeguard Ethereum

The Ethereum Foundation (EF) updated its protocol roadmap for 2026, highlighting three priorities: scaling, better UX and protecting the base layer.

Source: EF blog.

Source: EF blog.On scaling, developers will work on boosting L1 throughput and data availability. The main goals include:

- stepwise lifting of the gas limit to 100 million and beyond. This is to be achieved via block‑level access lists (EIP-7928) and regular client performance testing;

- preparing the Glamsterdam hard fork. The upgrade envisages a built‑in PBS mechanism (ePBS, EIP-7732), a rethink of operation costs and higher limits for BLOB objects;

- launching an attester client based on zkEVM. The tool is to be readied for full mainnet use;

- storage optimisation. Work includes pruning stale data and moving to binary trees (a statelessness architecture).

On UX, the focus shifts to native account abstraction and cross‑chain interaction (interoperability).

According to developers, EIP-7702 was an important step; the end‑goal is to make smart‑contract wallets the default, without intermediaries or extra gas. Next up—EIP-7701 and EIP-8141—which embed smart‑account logic directly into the protocol.

The base layer becomes a new workstream aimed at preserving Ethereum’s fundamentals as it scales, with work spanning security, censorship resistance and stability.

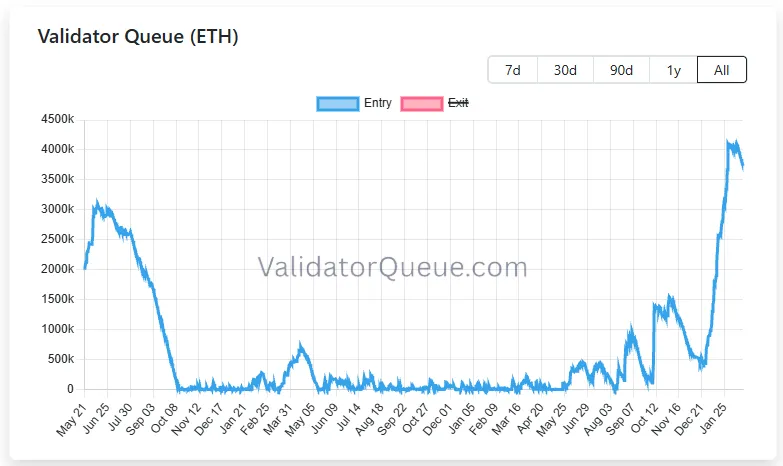

Meanwhile, Ethereum’s share in staking reached a record 50%. The calculation of 50.18% (80.95m ETH ($1,950.83 · Live)) is based on the asset’s historical issuance before the burning mechanism was introduced. Around 120m ETH are currently in circulation.

Source: Santiment/X.

Source: Santiment/X.There are now 37.1m ETH locked in the mainnet, equal to 30.54% of supply. Active validators number 964,799.

Source: Validator Queue.

Source: Validator Queue. Militarised AI

WSJ reported that the US Army used Anthropic’s Claude chatbot in an operation to capture Venezuela’s president, Nicolás Maduro.

“We cannot comment on whether Claude or any other model was used in any specific operation—classified or otherwise. Any use of LLMs—whether in the private sector or in government—must comply with our policy governing how the model is deployed. We work closely with partners to ensure the rules are followed,” a company representative said.

Such use would run counter to Anthropic’s public policy, which explicitly bans employing AI for violence, weapons development or surveillance.

Claude’s adoption by the Pentagon became possible via Anthropic’s partnership with Palantir Technologies, whose software is widely used by the military and federal law‑enforcement.

Reporters wrote that after the raid an Anthropic employee asked a Palantir colleague what role the model had played in the operation to seize Maduro. The startup denied the claim, and WSJ provided no further details.

After the story spread, Pentagon spokesman Sean Parnell said ties with the AI lab were under review. Relations with Anthropic were already strained.

Axios, citing sources, noted that the US military is pressuring four major AI firms (Anthropic, Google, OpenAI and xAI) to let the army use their technology for “all lawful purposes”.

At the same time, there were reports that the recently paired companies SpaceX and xAI of Elon Musk plan to develop software for the Pentagon’s autonomous weapons.

The firms are competing in a six‑month, $100m tender to build advanced “swarm technology capable of translating voice commands into digital instructions and controlling multiple drones”.

They are not the only participants. OpenAI is also backing Applied Intuition’s bid, but will confine itself to the “mission control centre” component that translates commanders’ voice orders into digital instructions.

Also on ForkLog:

- Study: stablecoins reduced remittance costs by 40%.

- Pump Fun changed its rewards model in favour of traders.

- Trading volume in tokenised xStocks exceeded $25bn.

- OpenClaw’s founder faced harassment from the crypto community.

Crypto payments in Belarus

Sputnik, citing Alexander Yegorov, chairman of the National Bank of Belarus, said that self‑employed workers in the republic will be able to receive payment for their services in cryptocurrency officially.

“Previously, if a designer or programmer fulfilled an order for a foreign client and they offered to pay in crypto, the person was in a grey area: they could not legally credit the money to an account or officially pay taxes on it. That barrier has now been removed,” he explained.

Payments in digital assets are to be made via crypto‑banks, which were legalised in January.

Such institutions are defined as joint‑stock companies—residents of the Hi‑Tech Park—from a special National Bank register. Alongside traditional services, they will be permitted to conduct operations with tokens.

“Blockchain technology, combined with state regulation, ensures a level of transparency ordinary banks could only dream of,” Yegorov said.

He added that crypto‑banks will also issue cards for point‑of‑sale payments. At checkout, cryptocurrency will be automatically converted into Belarusian roubles at the prevailing rate.

What else to read?

“Smart” does not equal “understanding”—the mistakes we make when we anthropomorphise algorithms.

We explain why graphics cards turned into a resource for the AI industry, why Nvidia no longer loves gamers, and why freelance designers have to rent power from cloud data centres.