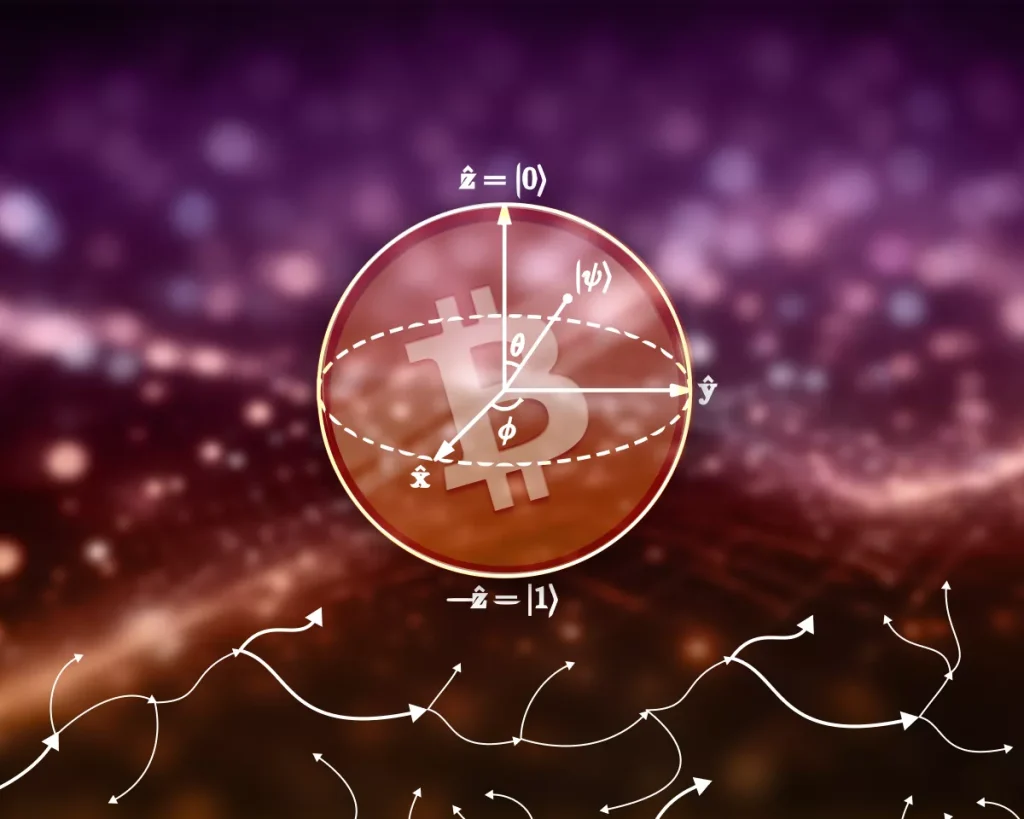

Major institutional investors may lose patience with Bitcoin developers over delays in addressing quantum computing issues, stated Castle Island Ventures partner Nic Carter during the Bits and Bips podcast.

Is Bitcoin headed for a corporate takeover?

@nic__carter joins @ramahluwalia, @austincampbell, and @perkinscr97 on this week’s Bits + Bips.

They discuss:

🏢 BlackRock’s growing leverage over Bitcoin development

💀 The end of the VC-backed token cycle

🤖 Why AI may dwarf the… pic.twitter.com/cm6ocJuqRr

— Laura Shin (@laurashin) February 11, 2026

“I think developers will continue to do nothing. […] Institutions will likely tire of this, fire the team, and hire a new one,” he added.

Carter drew an analogy with BlackRock. According to him, the investment giant “will have no choice” due to the large amount of money invested in the leading cryptocurrency.

The Castle Island Ventures partner warned that if Bitcoin developers do not take urgent measures to implement quantum-resistant cryptography, it will lead to a “corporate takeover” of the blockchain.

Austin Campbell, founder of Zero Knowledge Consulting, expressed a similar view:

“If there is a structural problem here, and they have a shared vision, eventually developers will need to speak out.”

However, Lumida Wealth Management co-founder Ram Ahluwalia disagreed. He pointed out that major institutions in the Bitcoin space are “passive” investors.

Carter has repeatedly warned about the quantum threat to the leading cryptocurrency. In his assessment, the potential danger is already putting pressure on the digital gold’s prices due to growing investor concerns.

In December 2025, Blockstream CEO Adam Back criticized the Castle Island Ventures partner for exaggerating the issue. In his view, Bitcoin developers do not deny the risks and are conducting relevant research.

Analyst Willy Woo believes that in the event of a hypothetical quantum attack on Satoshi Nakamoto’s wallets, “old whales” will protect the market.