Ethereum’s price has managed to hold above the $2,000 even as heightened volatility persists in the market. During the recent pullback, investors’ sentiment appears to be slowly leaning toward a bullish outlook, which is primarily indicated by the notable ETH withdrawals from crypto exchanges, matching key past levels.

Exchanges Are Seeing Massive Ethereum Withdrawals

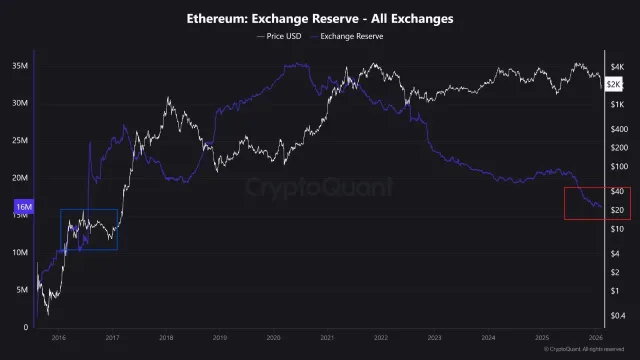

Following the sharp pullback in price, Ethereum’s on-chain supply dynamics have now reached a striking milestone. This milestone is taking place on the ETH exchange reserves, which have experienced one of their steepest drop in years.

In a post on the social media platform X, CryptoRus revealed that the ETH supply on crypto exchanges has fallen back to levels last seen in mid-2016. “That’s wild when you think about how much bigger the ecosystem is today,” CryptoRus added.

The significant decline in ETH on centralized platforms indicates that, instead of having their coins easily accessible for sale, more investors are transferring them into long-term storage, staking, or self-custody. Such a development often signals reduced selling pressure and a stronger long-term holder base.

Ethereum investors are showing more notable bullish sentiment towards the altcoin than Bitcoin investors. While Bitcoin has recently returned to crypto exchanges, ETH has been silently disappearing from these platforms. The behavior underscores increasing conviction in the altcoin’s near-term and long-term prospects compared to BTC.

The majority of this ETH is not lost or abandoned. Rather, it is owned by investors, and they are not sitting on the sidelines. At the same time, Over-The-Counter (OTC) supply has also increased, but it is still far behind in comparison to the total supply of Ethereum.

If OTC liquidity also dries up and ETH exchange balances remain this tight, price discovery will occur quickly rather than smoothly. Nonetheless, when demand returns to the market, there may not be enough ETH available to fill that desire.

Institutions Are Still Buying More ETH In Unfavorable Conditions

Despite the ongoing volatile landscape, Ethereum institutional accumulation has continued, and big firms like Bitmine Immersion are not done buying the dip. The leading public company has recently made another ETH purchase that is making waves in the cryptocurrency community.

On-chain data shared by Ash Crypto, a market expert and investor, shows that Bitmine bought about 20,000 ETH valued at $41.08 million on Monday. This purchase implies that big players are displaying renewed confidence and betting on a potential bounce in the near future.

According to the expert, the company’s total ETH purchase last week alone was valued at $83.45 million. After the purchase, Bitmine’s ETH holdings skyrocketed to $9.19 billion, representing over 3.6% of the total ETH supply. Bitmine’s persistent ETH purchase underscores the firm’s unwavering goal to become the largest Ethereum treasury company in the world.

Featured image from Freepik, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.