Reports say an on-chain analytics account called Rand flagged a new milestone: crypto funds have recorded three straight months of outflows for the first time on record.

Related Reading

That streak stands out because it breaks the pattern of sporadic withdrawals and inflows that marked earlier market cycles. Many investors are watching closely.

Outflows Reach A Historic Turning Point

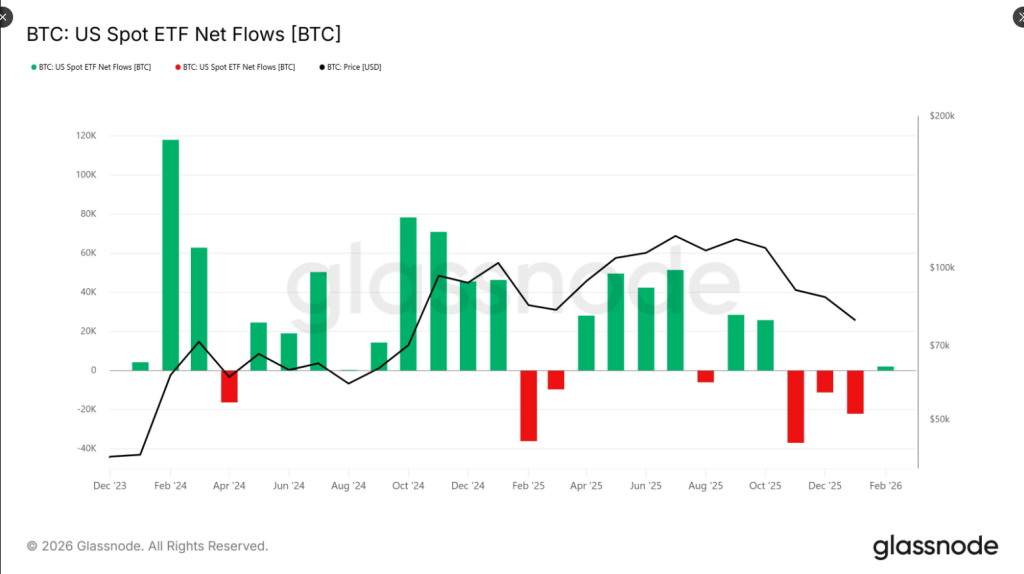

According to market watchers, the run of withdrawals covers both retail and institutional flows. Spot Bitcoin exchange-traded funds (ETFs) in the US have been a major focus, with inflows that were once enormous now trimming down.

Some of the earlier gains that piled into ETFs have been partially reversed, leaving holders with paper losses that many see as painful right now.

US 🇺🇸 spot #Bitcoin ETF’s recorded 3 months of net outflows in a row.

The first time in history that there has been 3 consecutive months of outflows. pic.twitter.com/WusDpXuSSm

— Rand (@cryptorand) February 3, 2026

ETF Investors Holding Their Ground

Reports say several prominent analysts have pointed out that, while the recent bleed looks alarming, ETF holders haven’t fled.

James Seyffart noted that holders remain largely in place despite steep paper losses.

Jim Bianco weighed in too, suggesting the average ETF stake is underwater by a meaningful margin yet still being held.

This is not a full-scale selloff; it’s a slow retreat for now. Large sums entered the market during the peak months and those inflows dwarf the recent outflows when measured over the longer run.

Sentiment has shifted, but conviction has not collapsed.

What The Numbers Show

Over 30 days, spot Bitcoin’s price slid by a sizable amount, and that drop helped push ETF positions into the red. Reports show some holders face losses around the low 40%, while shorter windows show steeper swings.

The math is simple: big gains came fast, and some of that profit has been given back. At the same time, net positions remain sizable and a fair share of the capital that flowed in earlier is still parked in ETFs.

Long Term Gains Versus Short Term Pain

According to other market commentators, the bigger picture still favors those who kept faith through the rally years. Since 2022, Bitcoin’s cumulative rise outpaced several traditional stores of value, say analysts tracking long-term performance.

That record is raised as a counterpoint to the current outflow story. Some investors see the current weak stretch as a pause; others see it as a warning.

Related Reading

What Comes Next

The three-month outflow run is a sobering marker. It signals caution has spread beyond a handful of traders and reached products that many thought would smooth volatility.

Money can return just as quickly as it left, or the slow drip could continue. For now, reports and the data both show a market in a rare place: bruised, but not emptied.

Featured image from Unsplash, chart from TradingView