What to Know:

- Brazil’s new legislation mandates 1:1 backing for stablecoins, effectively banning algorithmic models to protect consumers and pave the way for the Drex digital currency.

- The regulatory squeeze on experimental assets is driving capital toward fundamental infrastructure projects that solve scalability and utility issues.

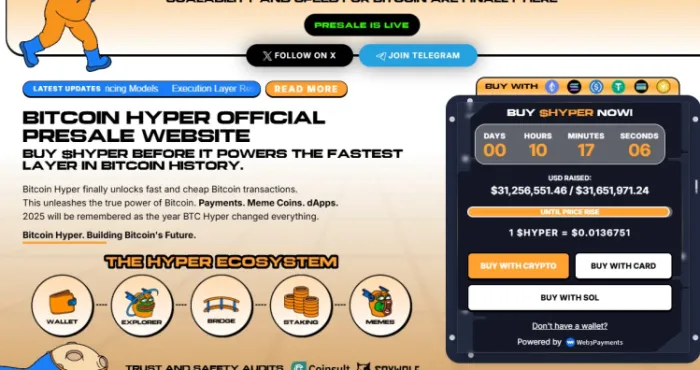

- Bitcoin Hyper ($HYPER) utilizes the Solana Virtual Machine (SVM) to bring high-speed smart contracts to Bitcoin, raising over $31 million in its ongoing presale.

- Whale activity confirms institutional interest in Layer 2 solutions, with significant on-chain purchases recorded in early 2026.

Brazil is tightening its grip on crypto. New legislation advancing through the Chamber of Deputies explicitly targets algorithmic stablecoins, mandating that issuers maintain strictly 1:1 reserve backing with fiat currency or high-quality liquid assets.

Practically, Bill 4.308/2024 outlaws the algorithmic model, think Terra’s UST or Ethena’s USDe, within the country.

The bill forces issuers to segregate client funds entirely from proprietary capital, a direct response to the liquidity blowups that defined the last bear market. But for the Brazilian Central Bank (BCB), this isn’t just about consumer protection. It’s strategic. By squeezing out mathematically stabilized assets, regulators are clearing the deck for ‘Drex’ (the digital real) and fully compliant private alternatives.

Brazil is a bellwether for Latin American adoption, so this matters. The ban signals a broader trend: pushing ‘experimental’ DeFi to the fringes while directing capital toward tangible infrastructure. Frankly, the market hates uncertainty. While bans sound harsh, clear guardrails usually precede institutional entry.

As the door closes on risky yield products, smart money is rotating into infrastructure layers that offer utility rather than just financial engineering, a shift fueling Layer 2 solutions like Bitcoin Hyper ($HYPER).

SVM Integration Brings High-Speed Execution To Bitcoin

While regulators fixate on stability, the market is hunting for velocity. Bitcoin remains the gold standard for security (hence the regulatory preference), but it’s still painfully slow for high-frequency commerce.

Bitcoin Hyper ($HYPER) fixes this by integrating the Solana Virtual Machine (SVM) directly as a Layer 2 on top of Bitcoin.

This architecture is a major departure from the standard EVM-on-Bitcoin approach. By using the SVM, Bitcoin Hyper achieves the sub-second finality and low-latency performance users expect from Solana, but anchors that activity to the Bitcoin network. For developers, it unlocks the ability to write smart contracts in Rust that interact with native $BTC liquidity, minus the congestion of the main chain.

Separating consensus (Bitcoin L1) and execution (SVM L2) creates a modular environment where payments can scale horizontally. That distinction is vital. As Brazil demands fully backed assets, the need for a high-performance network to transact those assets grows. Bitcoin Hyper effectively creates a “fast lane” for the world’s most secure collateral.

Smart Money Targets Infrastructure As Presale Crosses $31M

The market’s appetite for this ‘Bitcoin-security, Solana-speed’ hybrid is showing up in the numbers. The Bitcoin Hyper presale has already raised over $31.2M, with the token price currently at $0.0136751. That level of capitalization suggests investors are looking past short-term regulatory noise and betting on long-term infrastructure plays.

Chain data shows this isn’t just retail money. Etherscan records indicate that three whale wallets have accumulated $1M combined in recent transactions ($274K, $379.9K, $500K).

This fits the classic ‘flight to quality’ narrative. When regulators like Brazil crack down on algorithmic experiments, capital creates a bottleneck. That liquidity has to go somewhere, and it usually flows into projects with identifiable technical moats.

The risk? Execution, bridging two distinct architectures is complex. But the potential reward for unlocking Bitcoin’s $1T+ capital base for DeFi is clearly driving the current valuation surge.

This narrative could push $HYPER at the top of the food chain in 2026 and beyond.

The content provided in this article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry inherent risks, including regulatory changes and market volatility. Always perform your own due diligence before investing.