Bearish sentiments continue to dominate the Bitcoin market as the premier cryptocurrency looks to record a fifth consecutive monthly loss. Presently, prices are consolidating beneath the $70,000 mark, as market bulls struggle to force a decisive breakout above the resistance zone.

Amid this choppy price action, data from the Bitcoin options market shows that traders are beginning to expect less volatility but still acknowledge the fragile nature of the market.

Related Reading

Bitcoin Volatility Expectations Drop, Market Panic Fades

In an X post on February 20, Glassnode shared its weekly Bitcoin options market update, analyzing the traders’ behavior and sentiment in relation to present market conditions. The market analytics firm reports a notable change in volatility expectations that helps to subside the presently heightened bearish sentiments.

According to Glassnode analysts, At-the-money (ATM) implied volatility across maturities has significantly dropped to around 48%, down significantly from recent highs. Because ATM IV reflects the market’s expected move, the decline suggests traders are no longer betting on an immediate price crash.

Notably, this shift is reinforced by moves in DVOL, an indicator for measuring aggregate implied volatility expectations. Following initial spikes during the market liquidation in late January/early February, DVOL has fallen by roughly 10 volatility points over the past two weeks, signaling that extreme hedging demand is easing out.

In addition, the short-term volatility risk premium (VRP) has turned positive. Earlier this month, one-week VRP plunged to deeply negative levels at -45, as realized volatility far exceeded implied. Since then, implied volatility has repriced higher while realized volatility has stabilized, restoring a premium in short-dated options.

Together, these metrics suggest that panic pricing is being reset, and expectations for outsized, volatile moves have declined.

Related Reading

Bitcoin Traders Remain Alert To Downside

Despite the cooling in volatility expectations, other metrics show that traders are maintaining a defensive market position.

For example, the Put skew, which measures the relative demand for downside protection versus upside exposure, remains quite heightened despite moving off the extreme hedge. After bottoming near the 7 volatility points, the one-week 25-delta skew has rebounded toward 14 vol. The recovery indicates that while extreme fear has subsided, demand for downside insurance remains firm.

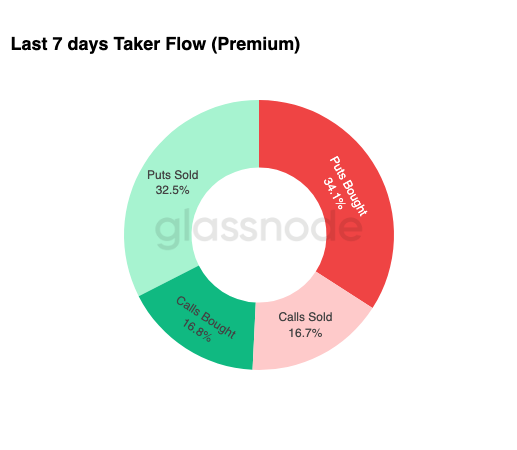

The taker flow data also tells a similar story. Puts represented two-thirds of last week’s options activity, with outright put buying representing about 34% of total flow. The dominance of protective positioning suggests that market participants are not fully convinced the correction has run its course.

In conclusion, the options market is signaling a more measured outlook, where expectations for immediate turmoil have faded, but traders are hedging to hedge against the risk of another downside. At press time, Bitcoin trades at $67,628 following a 0.92% gain in the last 24 hours.

More data from Glassnode also shows that Dealers are broadly short gamma across a wide price range between $70,000 and $58,000, a positioning structure that could amplify selling pressure if Bitcoin extends losses. Conversely, a large gamma concentration around $75,000 suggests positioning for a potential rebound.

Featured image from Flickr, chart from Tradingview