Crypto venture capital firm Dragonfly Capital has closed its fourth fund, raising $650 million to invest in what it sees as the next phase of blockchain companies.

The new vehicle is Dragonfly’s fourth fund, according to an X post by fund general partner Rob Hadick. Fortune reported that rather than chasing consumer apps, the firm hinted that it is targeting more traditional financial products built on blockchain rails, including credit card-like services and money market-style funds, as well as tokens tied to real-world assets such as stocks and private credit.

The shift reflects a broader pivot in crypto toward financial infrastructure and onchain finance, including payments, lending, stablecoin systems and tokenized real-world assets.

“This is the biggest meta shift I can feel in my entire time in the industry,” said Tom Schmidt, a general partner at Dragonfly.

The fundraising comes after what Hadick described as a “mass extinction event” in the crypto VC ecosystem, as higher interest rates and token price declines thinned the investor pool.

Dragonfly previously raised about $100 million for its first fund in 2018, roughly $225 million in 2021 and $650 million in 2022. The latest $650 million fund signals that, despite the downturn in crypto venture investing, sizable pools of capital are still backing projects that aim to connect blockchain technology more directly with traditional finance.

Related: VC Roundup: Amid crypto funding slump, stablecoin, RWA infrastructure draw capital

Crypto VC priorities, focus areas shift

Venture funding for blockchain companies cooled in 2025, but that doesn’t mean capital disappeared. Instead, the mix has changed.

Traditional early-stage venture deals slowed, while more money began flowing through public listings, private investments in public equity (PIPEs), debt raises and post-IPO equity offerings — a sign that more mature crypto companies are tapping public markets rather than relying solely on seed rounds.

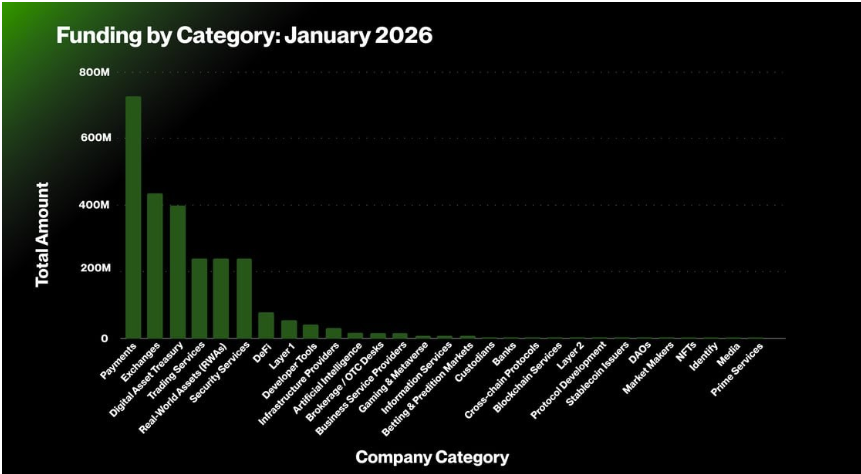

The shift appears to be gaining momentum in 2026. Last month, 111 crypto companies raised a combined $2.5 billion across IPOs, PIPEs, debt and equity offerings, according to data from The TIE. That figure suggests institutional capital is returning, even if it’s flowing through different channels than during the last bull cycle.

The sector focus has also evolved. Instead of backing layer-1 blockchains and consumer-facing apps, investors are directing capital toward stablecoin infrastructure, institutional custody, digital asset treasury strategies and trading platforms.

Related: ‘Massive consolidation’ expected across crypto industry: Bullish CEO