YouTube star Logan Paul has set a new Guinness World Record, selling his rare Pokémon card for nearly $16.5 million on Monday — the most expensive card sale in history — though the new record sale didn’t come without controversy.

The auction for the Pikachu Illustrator Pokémon card — one of 39 created in a competition in the 1990s — was won by AJ Scaramucci, the son of American financier Anthony Scaramucci, outbidding several others who made offers in the seven- and eight-figure range.

Paul is believed to have made an $8 million profit after auction fees on Monday. He bought the card for $5.3 million in July 2021.

.@LoganPaul‘s rare @Pokemon card becomes most expensive ever sold in record-setting auction.

The PSA-10 Pikachu Illustrator went on sale via @GoldinCo and eventually sold for $16,492,000.https://t.co/B1YBUIqhbx

— Guinness World Records (@GWR) February 16, 2026

However, the record sale reignited criticism over Paul’s move to fractionalize ownership of the card on Liquid Marketplace in 2022 before the platform went offline, leaving investors scrambling for returns and prompting a lawsuit in Canada.

In a post to X on Monday, Delphi Labs general counsel Gabriel Shapiro said Paul’s “Pikachu NFT fractionalization fiasco” is a “classic case of ‘slop tokenization.’”

“The token is basically just ‘juxtaposed’ with property but has no rights to it,” Shapiro said, urging investors to read the terms of service and to stop rushing into “legal scams.”

Paul addressed the criticism, stating that Liquid Marketplace went offline for reasons beyond his control and that, once aware of the issue, he paid to restore the site so users could withdraw their funds.

Only 5.4% of the card was fractionalized to owners who paid about $270,000, Paul noted.

Paul isn’t named in the Liquid Marketplace lawsuit brought by the Ontario Securities Commission, Canada’s top securities regulator, in June 2024. A hearing is scheduled for June.

Logan Paul’s past NFT drama

It isn’t the first time Paul has had to defend himself over his involvement in NFTs. His CryptoZoo NFT project failed to deliver its promised play-to-earn game, drawing investor backlash and a class-action suit in 2023.

Related: US prosecutors drop OpenSea NFT fraud case after appeals court reversal

He set up a buyback program and eventually paid investors back after they agreed to waive legal claims, and the class-action fraud lawsuit was ultimately dismissed in 2025.

Other NFT investments by Paul have also flopped, including an anime-style digital avatar from the 0N1 Force collection he bought for around $635,000 in 2021 that is now valued at under $2,000.

NFT market continues to slide

The record Pokémon card sale also stands in contrast to the struggling NFT market, which deals in digital collectibles.

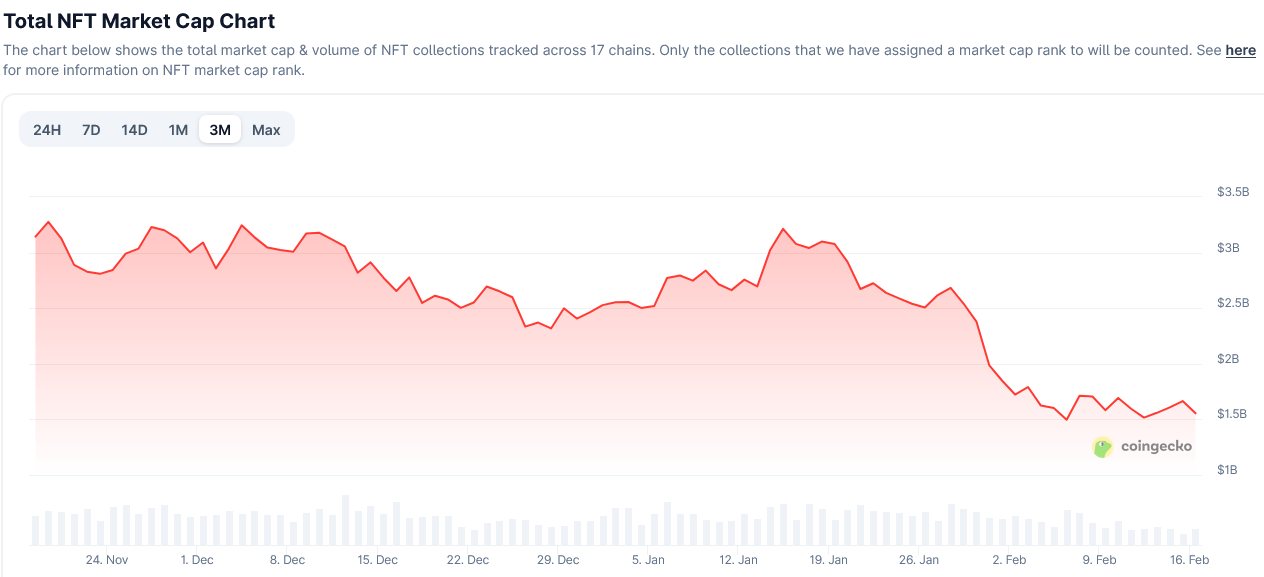

While the NFT market started strong in the first two weeks of 2026, the total NFT market cap has since fallen by more than 50%, from $3.2 billion to $1.55 billion amid a broader market pullback.

Last month, NFT marketplace Rodeo and Nifty Gateway announced in the last week of January that they would wind down operations, adding to the sector’s string of high-profile closures.

Magazine: Chinese New Year boosts interest, TradFi buying crypto exchanges: Asia Express