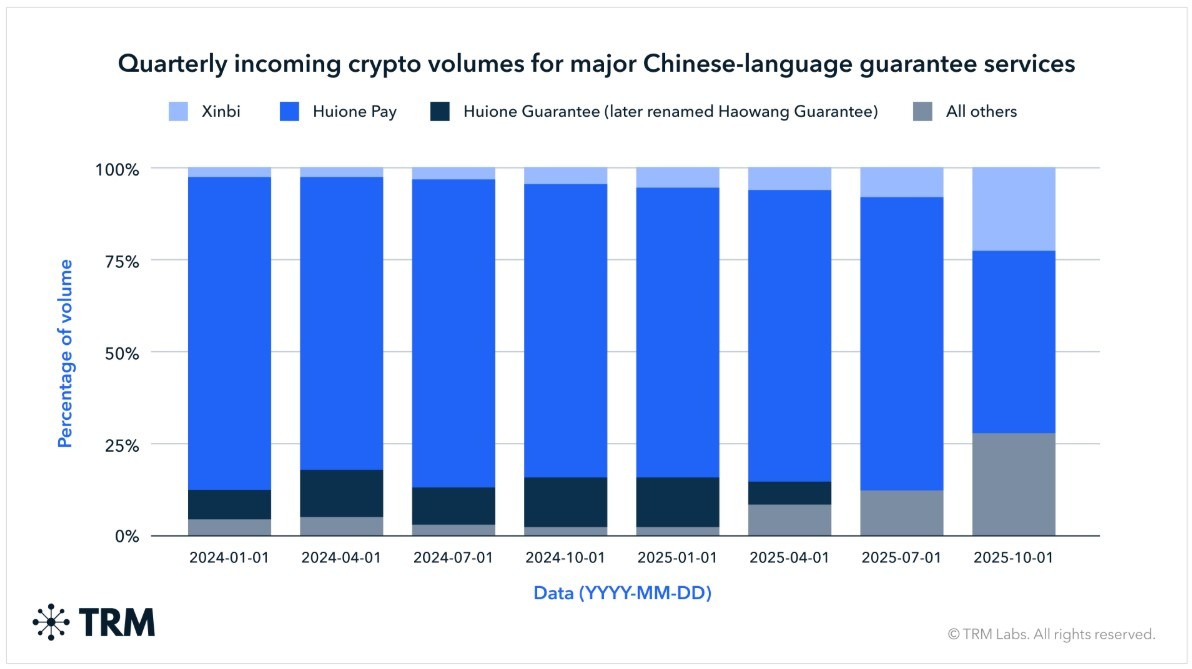

A Chinese-language crypto guarantee marketplace known as Xinbi processed nearly $18 billion in onchain transaction volume despite platform bans and United States enforcement actions aimed at dismantling similar services, according to a new report from TRM Labs.

The report said recent crackdowns — reshaped but failed to dismantle — a key layer in crypto-enabled laundering infrastructure. TRM’s analysis showed that Xinbi sustained on-chain activity after Telegram banned clusters of Chinese-language guarantee services in 2025.

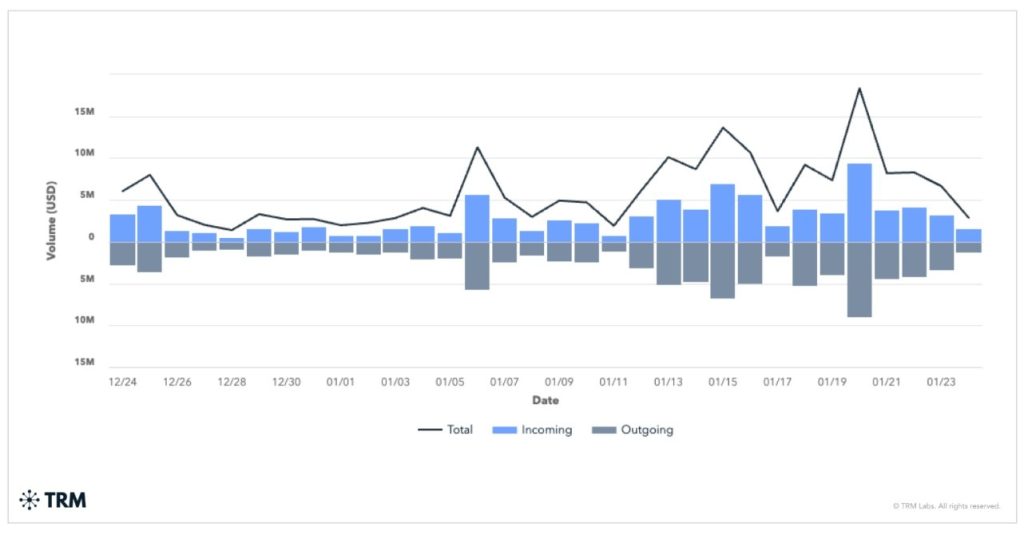

The report attributes Xinbi’s resilience to rapid migration to alternative messaging services and the launch of an affiliated wallet, XinbiPay. Onchain data showed wallet activity rebounded in January 2026 as users transitioned to the new setup.

The analytics firm said Xinbi has allegedly played a central role in allegedly laundering proceeds for scam operations and cybercrime syndicates, including pig-butchering fraud schemes.

The $17.9 billion figure reflects gross onchain transaction volume processed by wallets attributed to Xinbi by TRM. This includes inflows, outflows and internal transfers within the platform’s escrow and wallet system.

TRM said the figure does not represent the net proceeds or confirmed illicit gains, and may include internal recycling of funds, which is common to guarantee services.

Alleged illicit guarantee service Xinbi adapts to enforcement

In a statement sent to Cointelegraph, Ari Redbord, global head of policy at TRM Labs, said services like Xinbi are adapting.

“Guarantee services like Xinbi are learning to survive enforcement by fragmenting across platforms and building their own infrastructure,” Redbord said.

“These services sit at the center of the scam economy,” he said, adding that taking them out of the laundering chain exposes entire networks that depend on them.

TRM said Xinbi started promoting alternative channels for coordination as early as mid-2025, laying the groundwork for migration as enforcement pressure intensified.

The analytics firm said the transition accelerated in January, coinciding with additional actions against peer services and arrests tied to laundering networks.

Related: Crypto thieves, scammers plunder $370M in January: CertiK

Xinbi previously flagged over $8 billion in stablecoin flows

Xinbi has been under scrutiny since 2025. In May, blockchain analytics firm Elliptic reported that wallets linked to Xinbi Guarantee had received at least $8.4 billion in stablecoins, tied to money laundering and scam-related activity in Southeast Asia.

The earlier report linked Xinbi to a Chinese-language, Telegram-based marketplace selling money laundering services, stolen data, scam-enabling tools and other illicit offers.

Magazine: Crypto loves Clawdbot/Moltbot, Uber ratings for AI agents: AI Eye