Today in crypto, The US has granted national bank charter to crypto startup Erebor Bank, China issued a ban on unapproved stablecoin and tokenized real-world assets. Meanwhile, Trend Research unloaded over 400,000 ETH to repay loans.

Crypto-focused Erebor wins first new US bank charter of Trump’s second term: WSJ

The United States has approved a newly created national bank for the first time during President Donald Trump’s second term, granting a charter to crypto-friendly startup Erebor Bank.

The Office of the Comptroller of the Currency (OCC) confirmed the approval on Friday, allowing the lender to operate nationwide, the Wall Street Journal reported, citing people familiar with the matter.

The institution launches with about $635 million in capital and aims to serve startups, venture-backed companies and high-net-worth clients, a segment left underserved after the 2023 collapse of Silicon Valley Bank.

Erebor is backed by a roster of prominent technology investors, including Andreessen Horowitz, Founders Fund, Lux Capital, 8VC and Elad Gil. The project was founded by Oculus co-creator Palmer Luckey, who will sit on the board but not manage daily operations.

China bans unapproved stablecoins and RWA issuance

The People’s Bank of China, together with seven other regulatory bodies, issued a joint statement banning the unapproved issuance of yuan-pegged stablecoins and tokenized real-world assets (RWAs) by both domestic and foreign companies.

According to the announcement, no entity or individual, whether inside or outside China, may create or issue Renminbi-linked stablecoins without explicit approval from regulators. That includes offshore versions tied to the yuan, closing a loophole that some had hoped might allow crypto activity to persist around China’s borders.

The move also extends long-standing restrictions on cryptocurrencies by formally folding RWA tokenization into China’s risk framework. Authorities view converting real assets into tradable tokens without approval as potentially illegal financial activity.

The regulators argue this step is part of a broader strategy to keep speculative digital assets outside China’s formal financial system while promoting the use of the state’s digital yuan (e-CNY).

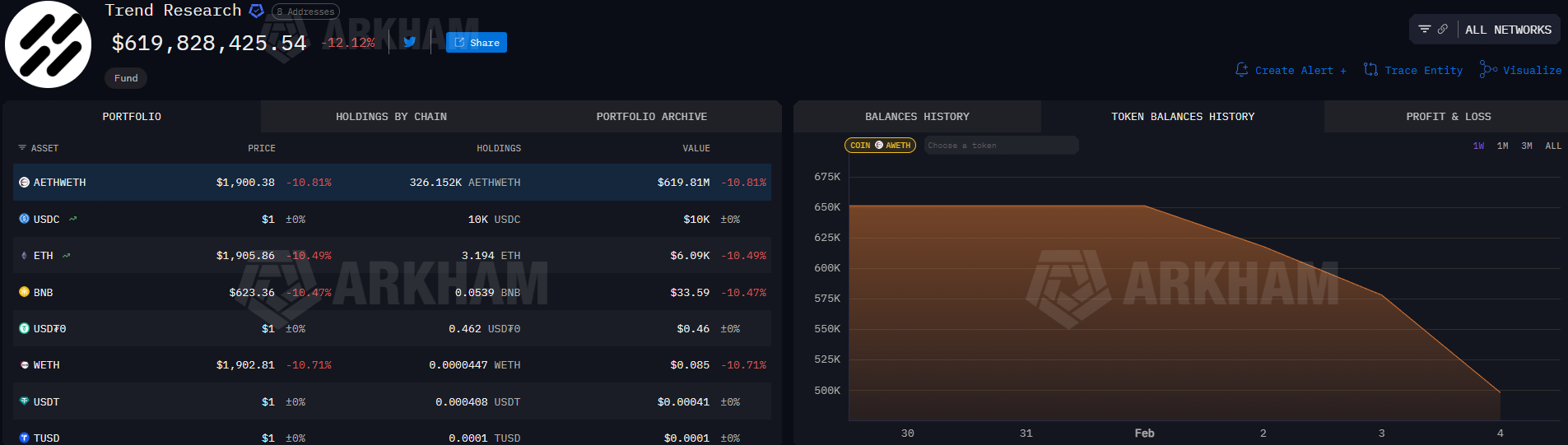

Trend Research dumps over 400K ETH as liquidation risk rises

Ethereum investment vehicle Trend Research continued to reduce its Ether exposure, as the latest market crash pushed the treasury company to sell off its assets to pay back loans.

It held about 651,170 Ether (ETH) in the form of Aave Ethereum wrapped Ether (AETHWETH) on Sunday. That amount dropped by 404,090, to about 247,080 on Friday, at the time of writing.

Trend Research transferred 411,075 ETH to cryptocurrency exchange Binance since the beginning of the month, according to blockchain data platform Arkham.

The transfers occurred as ETH price dropped almost 30% in the past week, to as low as $1,748 on Friday, according to CoinMarketCap. It traded at $1,967 at the time of writing.

Trend Research has been tied to Jack Yi, founder of Hong Kong-based crypto venture firm Liquid Capital. Yi accumulated his Ethereum investment company’s holdings by purchasing ETH at an exchange, using that as collateral on Aave to borrow stablecoins, then using those funds to acquire more ETH.