With volatility intensifying in the broader cryptocurrency market, the price of Ethereum has fallen sharply, drawing dangerously close to the $2,000 level. While there are speculations that the ongoing trend is akin to a bear market phase, investors seem to be unshaken by the sharp pullback in ETH’s price, with accumulation not showing signs of slowing down.

Investors’ Behavior After Ethereum’s Drop Below Realized Price

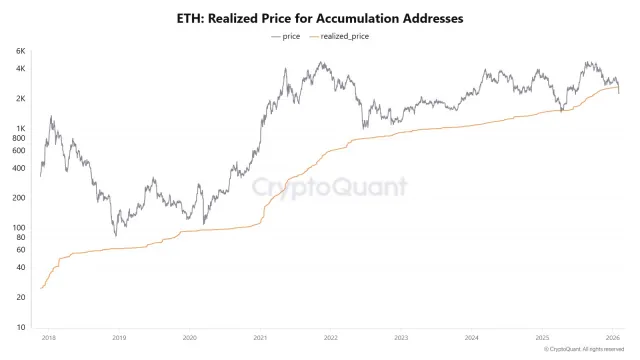

Following the sharp pullback on Tuesday, the Ethereum price has now fallen below a key level regarded as the Realized Price. Despite the price experiencing steady downside movements, investors are moving in the opposite direction, as evidenced by their continued interest in the leading altcoin.

Related Reading: Ethereum Holders Jump 3% In January, Clear 175 Million Milestone

According to CW, a market expert and investor, investors continue to steadily stack the altcoin even with ETH trading below its realized price, which puts a large portion of the market in unrealized loss territory. On-chain data points to continued accumulation from large holders or whales and conviction-driven buyers.

What’s interesting about the whale’s action is that these investors are persistently accumulating Ethereum despite being in a loss. Large investors sitting on unrealized losses are still buying, which is a pattern typically linked to heightened stress and shifting sentiment across the network.

Even with the current pullback, ETH inflows into accumulation addresses have also increased. CW highlighted that Ethereum had previously hit this level in April of last year, but it swiftly recovered before rising again. When the buying power of whales remains intact, this implies that the group has found the current price attractive. As a result, a significant rebound in ETH’s price is expected in the near future.

ETH Seeing Heightened Social Media Interest

Ethereum may be struggling with volatility, but the leading altcoin is experiencing increased interest from investors and social media participants. This is because of price movements, investment strategies, staking, and its potential as a deflationary asset following upgrades like EIP-1559 and the merge.

Related Reading: Here’s How Ethereum Staking Transforms Into A Multi-Billion-Dollar Bet For Bitmine Immersion

Data from Santiment, a popular on-chain data analytics firm, shows that ETH is commonly brought up in flash deals and cryptocurrency trading services, emphasizing its usage across platforms such as Binance, MetaMask, and Trust Wallet.

ETH’s increased social media mentions are attributed to the massive buying activity by BitMine. The company recently bought a large amount of ETH, signaling robust confidence in the altcoin’s future despite ongoing market volatility and unrealized losses.

CW reported that the company has acquired another 20,000 ETH, valued at approximately $46.04 million, through FalconX. With this purchase, Tom Lee’s Bitmine now boasts over 4.305 million ETH, worth a staggering $9.99 billion, which represents about 3.56% of the total ETH supply.

Despite this massive figure, Bitmine’s goal is to own 5% of all ETH supply. Bitmine remains the largest Ethereum treasury company in the world, with 2.87 million of its ETH holdings being locked away in staking. Other coins owned by the company include Bitcoin, of which they hold over 193 BTC.

Featured image from Pexels, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.